Economic Update April 2022

In this month’s update, we provide a snapshot of economic occurrences both nationally and from around the globe.

Key points:

– US inflation pushes higher and the US Fed starts hiking interest rates

– The Ukraine invasion by Russia has not escalated beyond expectations but has become more protracted

– Commodity prices and $A bounce on the Ukraine invasion and Australian economic data very strong

– The world re-opens despite Omicron and now BA2 but lockdowns in China continue to impact supply chains

– China economy bounces back from a weaker second half of 2021

We hope you find this month’s Economic Update as informative as always. If you have any feedback or would like to discuss any aspect of this report, please contact your Financial Adviser.

The Big Picture

While the devastation and casualties continue to mount in the Ukraine, worst-case scenarios seem thankfully to have been avoided – at least so far.

The resilience of the Ukrainian people has reportedly been outstanding. The West has contributed in many ways but it has not attempted to inflame the situation by moving troops too close to the action – or firing our own missiles.

As is usual, markets fell sharply on the first bad news but recovered after having realised they had priced in a worse outcome. With media outlets almost calling a stalemate in the Ukraine with Putin having failed, so far at least, to achieve his objectives (whatever they may have been), it would take fresh bad news to shake the market again. There is opinion forming that Putin might even be at risk of being ousted as leader.

Some of the success in preventing a worse outcome can be attributed to the co-ordinated sanctions being placed on some trade and the assets of the so-called seven oligarchs that amassed great wealth from links with Putin.

Superyachts, planes and property have been seized by various countries. The impact on the Russian economy has reportedly been massive. At the start of March, the Russian Central Bank increased its base interest rate from 9.5% to 20% in an attempt to cushion the rapid depreciation of the rouble.

As March drew to a close, there was some optimism that Putin was considering a ‘lesser objective’ and, indeed, recent talks between the two sides is offering a little more hope than previous talks.

While Ukraine is rightly taking centre stage on TV news, the great economic news from Australia, the US and China might have largely flown under the radar.

The US Federal Reserve (the ‘Fed’) raised its cash interest rate by 0.25% points to a range of 0.25% to 0.50% at its March meeting. It also signalled that it now expects six more hikes this year rather than the three in total it expected for 2022 at its December meeting. The forwards’ markets that price these outcomes have been swirling as each statement is made by a Fed member. US Federal Reserve (Fed) Chair Jerome Powell recently came out and predicted possible ‘double hikes’ of 0.50% points. As a result, markets have priced in a double hike at its next meeting on May 4th as being more than twice as likely as a single hike. There is no appetite for more than a double hike or conversely, staying on hold.

This interest rate news has also affected the US mortgage market. Unlike in Australia, their most common type of mortgage is a 30-year fixed-rate loan. It gives perfect foresight to the borrower as to what payments can be expected for the entire length of the loan. Moreover, as inflation builds over the 30 years, the repayments fall in inflation-adjusted terms.

The US 30-yr mortgage rate jumped sharply twice in the last week or so of March to 4.95%. Contrast that to our floating rates in the low two percent range. The US mortgage rate hikes and the recent increases in property prices mean that people are now paying 20% more a month than others were quite recently. That’s got to hurt! Existing mortgagees, of course, pay the same as they previously did because they bought a while back at the old prices and the rate was then fixed for the entire term. Only the new buyers suffer with the higher rate and this in turn might help cool the US property market.

With this change in monetary policy stance, the important question, now canvassed by even ‘sensible’ economists, is will this change by the Fed cause a recession? They have certainly been found guilty on a number of previous occasions!

In general, as a central bank raises rates to cool an economy – known as ‘monetary policy tightening’ – the rates for short terms, like 3-months to 12-months,rise in unison. For longer terms – say 10-yrs or more – interest rates may not move as much or at all. Most agree that expected inflation is the major determinant of longer term interest rates.

The ‘normal’ situation is that short term rates are lower than long term rates reflecting the increased risk to capital return over the longer term. These yields typically rise smoothly with the term of the bonds/term deposits. The array of yields for the different terms from short to long is called the yield curve when all plotted on the same chart, longer term yields typically flatten out after about 7-10 years. When rates at the short end are higher than at the longer end, the so-called yield curve is said to be inverted.

Back in 2019 the yield curve got close to being inverted and some called a recession would follow. While it is true that most recessions are preceded by an inverted curve, it is also true that not all inverted yield curves are followed by a recession.

It usually takes several factors to cause a recession. We argued in 2019 that the inverted yield curve was on its own not sufficient to justify a recession. As it turned out, there was a recession in 2020 but that was caused almost entirely by the unexpected shutdown in response to the Covid 19 pandemic – and not interest rates!

It is also important to note that some people consider the yield curve ‘spread’ for inversion to be the difference between the very short yield and the 10-yr yield while others focus on the difference between the 2-yr and 10-yr yields. Obviously, as the yield curve flattens out, the latter indicator is dominated more by very small movements in yield and hence is more likely to invert in turn increasing the potential for it to give a false signal. That said, any inversion of the yield curve should not be ignored and the reasons for it investigated.

It is equally important to note that the actual yield, rather than the yield ‘spread’ alone, must play a big role. If all rates were pretty close to zero (say less than 0.10%) it is difficult to see how any recessionary problems could emerge from an inverted yield curve. On the other hand, back in 2000 and 2006-2007, the 2-yr yields were over 5% when those yield curves inverted (on the ‘2yr-10yr’ spread definition) and each was followed by a recession. Today the 2-yr yield is closer to 2.5% – hardly the stuff of expensive borrowing costs compared to current inflation at around 6% to 7%.

Obviously, the Fed could cause a recession this time around so we shouldn’t rule it out. The Fed funds rate has a long way to go before inversion gets close (using the spread over the whole curve i.e. cash vs 10 yr) so we shouldn’t worry yet. Increasing the rate from the ‘emergency’ rate range of 0.00% to 0.25% by a little is not really tightening. Tightening doesn’t really start until the rate gets above the so-called ‘neutral rate’ which neither slows down nor speeds up the economy. There is no precise estimate of what the neutral rate might be, but most well-informed analysts say it was somewhere around 2.5%.

We are convinced many commentators do not properly understand the linkage between interest rates and inflation. There is no magic string that joins the two together. Rather, increasing the Fed funds rate (US cash rate) increases in turn the cost of borrowing for households and businesses. Those increases in costs slows down growth and take ‘demand side’ inflation pressures away.

Importantly, the US government debt is in the trillions of dollars so the Fed won’t want to shoot itself in the foot by recklessly hiking rates and increasing its debt funding costs.

A large contributor to current inflation in the US is due to supply-chain disruptions caused by the pandemic and surges in energy and ‘soft’ commodity prices (such as wheat) which are due to the Ukrainian situation and related causes. There is no linkage between the US funds rate and those two causes of inflation. Therefore, if the Fed kept trying to crank up interest rates until inflation collapsed, the economy would collapse before inflation dropped significantly.

We think that it is quite plausible that the Fed chair, Jerome Powell, fully understands these arguments. He has almost said as much. By cranking interest rates up just a little, he gets a lot of people off his case without causing a problem. Smart move! Let‘s not worry about the Fed funds rate until it gets to around 2.5% and that’s probably 2023.

Towards the end of the year Ukraine and supply-chain issues might be receding and inflation may then fall – but not in response to any modest rate rises. If that happens, Powell can then keep rates on hold until domestic causes of inflation really are a problem. If inflation does not fall because of the reasons given, he can point to the disconnect, so that more rate rises won’t help.

Recessions are always possible and typically come out of the blue. We see no reason to increase our expectation of a recession any time soon.

Getting back to the real economy, US jobs data were very strong and the unemployment rate is down to 3.8%. Wages growth came in at 5.1% in March but that is less than even the ‘core’ rate of inflation that strips out volatile energy and food prices. It is good that wages are rising because, otherwise, workers would be much worse off. There are no obvious signs of a wage-price spiral based on expectations (yet?).

At home our central bank, the Reserve Bank of Australia (‘RBA’), kept rates on hold. Our inflation is in the preferred ‘zone’ so we don’t need to raise rates at the moment. However, for the same reasons as the Fed, they might choose to make a very modest hike or two this year to get people off their case.

Our GDP growth came in at +3.4% for the quarter (Q4, 2021) which was distorted by a bounce-back from the Delta virus lockdown. Growth was +4.2% for the whole of 2021 and GDP is now +3.4% (not annualised) above where it was before the pandemic.

Home prices from the Australian Bureau of Statistics (‘ABS’) surged in 2021 in Australia – by 23.7% for the year. There is evidence from a private data source, CoreLogic, that house price growth has slowed to close to zero in the first three months of 2022. (No RBA interest rate rise was needed to cause that!)

Our unemployment rate fell to 4.0% which is the equal lowest in 48 years (see Federal Budget statement). 121,000 new full-time jobs were created. 20,000 would usually be called a big number. That is very good news, indeed.

March ended with our Federal Budget. There was no clear long-term policy direction – more of a mish mash of handouts in a typical election mode push. The Treasurer forecast growth of 4.25% in this financial year and 3.5% in the following year. Thereafter, to 2025-26, he forecast growth of 2.5% p.a. He also expects the unemployment rate to fall to 3.75%.

Even China data have been ‘on the bounce’. Retail sales were up 6.7% (for Jan/Feb combined) compared to an expected 3%; industrial production was up 7.5% compared to an expected 3.9%. China data got a bit soft last year as they pursued a zero-Covid policy. Indeed, China is now forcing a short, sharp shutdown for Shanghai in a bid to stop a new wave of infection. China is reportedly pumping stimulus into the economy which may account for the recent strong economic data.

Thankfully, China has not become too involved in the Russian invasion of Ukraine. Perhaps they appreciate the possible impact of sanctions on them if they were to pursue a reunification of Taiwan by force.

Stock markets are charging towards their all-time highs on the basis of good data and not too much economic impact in the West from the Ukraine invasion. Bond yields are now getting to the mid to high 2% range in the US and Australia but that is no match for the expected return in equities. Share markets are still supported by the TINA – there is no alternative – principle!

Asset Classes

Australian Equities

The ASX 200 gained +6.4% during the month of March which puts the index just up on the year-to-date (+0.7%). Much of the gains were due to the Resources sectors – Energy (+9.6%), Materials (+8.2%) – doing very well on much higher commodity prices. The Financials (+8.3%) and IT (+13.2%) sectors also performed particularly strongly.

International Equities

The S&P 500 (+3.5%) also had a strong month but not matching the gains on the ASX 200. Probably due to the Ukraine invasion, the London FTSE and the Frankfurt DAX struggled to keep pace. China and the broader Emerging Markets indexes went backwards in March. Over the year-to-date, the S&P 500 lost 4.9%.

Bonds and Interest Rates

The US Fed increased the Fed funds rates by 0.25% points in March – at their first meeting since December. In the December meeting, the Fed thought that they would need three hikes this year. The update to now is significantly different, one increase just done and six more to come. The reason for the shift is a material change in inflation expectations supported by a set of chunky inflation figures for recent periods.

We argued elsewhere in this update that much of the current inflation problem can simply not be fixed by hiking rates.

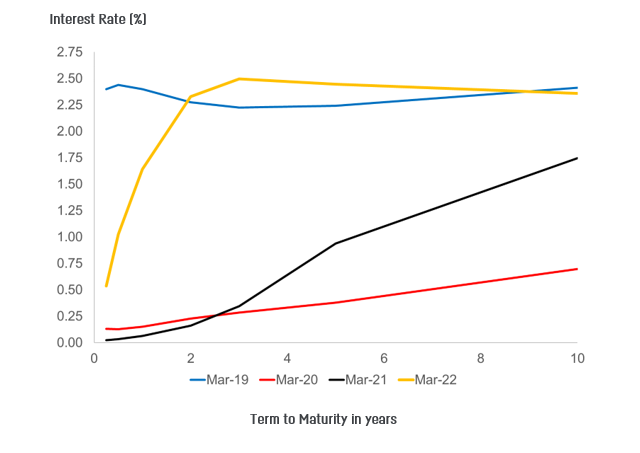

But before people panic and rush for the exits, some context is useful. If we look at the yield curve today, 12 months ago, 24 months ago and 36 months ago we see a really interesting evolution.

For 2-yr bonds to 10-yr bonds, the yield curves are just about the same now as in 2019. The difference is that today, the short-term yield is less than 0.5% and it rises steeply to about 2-yrs. Back in 2019, the whole yield curve was more or less flat.

US Yield Curves at March in each of the past 4 years

In other words, pushing the Fed funds rate up to about 2.50% – a massive change from the current rate, we may just about where we were in March 2019!

In 2020, the yield curve collapsed due to the pandemic across the whole term structure. In 2021, there was some recovery so the recent gains should be compared to the difference from 2019 and not from the crisis data.

In 2019, the world was a happier place – no pandemic; no Russian invasion of Ukraine; no spike in the prices of wheat and oil; no major supply-chain issues. We are simply edging back to normal with historically very low rates – even after a few more hikes. Panic now is the last thing we need.

The RBA did not raise rates at its March meeting nor do we think it should have done. The core CPI inflation read was bang in the middle of the 2% to 3% RBA-target band. Unemployment is 4% which is low but it has been a bit lower and we were still happy then.

The interesting question is why our inflation level is just fine but it is not so in the US and elsewhere. We live in a global economy.

Our economy is very different from that in the US. We are heavily dependent on resource exports – notably iron ore with a price going gangbusters. And the composition of our production is quite different. To be frank, we cannot explain all of the differences but, to some extent we don’t have to. All we need to know is whether our policy makers and industries are up to the challenges they face. We think they have been and see no reason for this to change.

Other Assets

The price of Brent Crude Oil gained +6.2% over the month. Not only was the invasion of Ukraine a cause but also rebels bombed oil storage facilities outside of the Saudi capital just before they staged the F1 Grand Prix in late March. US President Biden did just order the release of one million barrels per day from reserves to soften fuel prices.

The price of iron ore rose +13.9% and that for copper +5.7%. Importantly, the VIX ‘fear gauge’ retreated to below 20% almost to where it started the year but then just rose a fraction at the close of the quarter during Wall Street’s last hour sell-off. It peaked this year at 36.5% in March.

On the back of the stronger commodity prices, the $A (in US terms) appreciated strongly by +4.2% to nearly $US0.75.

Regional Review

Australia

As Australia lurches towards a federal election, both sides seem to be offering enticements but they are both falling short in other ways. Given what we know so far, it seems to be far less important than last time who wins – especially for folk who have super funds! The March budget delivered a number of handouts but there were no particular fresh long-term policy objectives. Super was largely untouched in a negative sense.

The latest economic growth for Australia covered Q4, 2021 came in at an impressive +3.4% but +3.7% had been expected because of the economic bounce-back. Noting this period was not affected by Omicron or the Ukraine situation and it did pick up the bounce back from the Delta lockdown. The annual figure was +4.2% for 2021 but that figure includes the bounce-back from the first big lockdown in 2020.

When we measure growth across the two years of the pandemic, total growth was +3.4% or about +1.7% p.a. That’s not too bad given the extreme public health responses Australia made.

Another important statistic in the national accounts is the household savings ratio. It is often fairly static but it bounces around when people’s hopes for the future markedly change. A mid to high single digit percentage is usual. It jumped to 19.8% in Q3 reflecting fear and a lack of opportunity to spend. That ratio fell to 13.6% in Q4 but it leaves a lot further to go to get back to normal. We expect strong growth to continue given these cashed-up consumers will have more opportunity to spend – and feel confident enough not to need a bigger ‘rainy day’ fund.

Our latest labour-force data relates to a week in the month of February so it doesn’t pick up the Ukraine invasion but Omicron was around. There were +121,000 new full-time jobs created but, as some part-time jobs were lost, the total number of new jobs was +77,400 – but that’s still very impressive. Having a switch from part-time to full-time work bodes well for growth expectations.

China

China data were much stronger than the last few months and much stronger than expectations. China usually combines data for January and February so that the moveable big Lunar New Year holiday has a more predictable impact.

That the three regular statistics of retail sales, industrial output and fixed asset investment all smashed expectations bode well for resource demand from Australia and China’s economy. Many commodity prices have boomed along with this recovery.

Two factors in China affect our economy the most. The zero-Covid policy means that it is much harder to make inroads into the supply-chain blockages. The relationship between China and Russia could cause major problems if they align too closely. But, so far so good. We are more than muddling through.

US

Last month we reported a bumper beat on the jobs front. This latest month was an even bigger beat! The +678,000 new jobs statistic was well ahead of the expected +440,000. The unemployment rate was 3.8% but the Fed chair has stated that a number such as this does not equate to full employment.

CPI inflation came in at 7.1% but the core rate that strips out volatile energy and food components was a more acceptable 6.4%. Wage growth was less at 5.1%. Core Private Consumption Expenditure (PCE) inflation – the Fed’s preferred measure of inflation – came in at 5.4%.

It is probably a good idea that Fed chair Jerome Powell is getting a little aggressive on interest rates as he will not want inflation expectations to start to spiral. He seems up to the task.

Europe

All of the action in March was again in Eastern Europe. The Ukrainians are putting up a stronger defence of their homeland than Russian President Putin could have imagined. There are reports that his undefined goals are being reduced. There is also talk of people wanting Putin out.

Rest of the world

In a disturbing turn of events, India is negotiating a banking deal with Russia. Some are worried that this could help Putin circumvent sanctions.