Economic update – June 2020

Within this month’s update, we share with you a snapshot of economic occurrences both nationally and from around the globe. We begin with a brief summary of the economic recovery.

- Equities continue to climb the wall of what appears to be ‘less worry’

- Economies are starting to re-open which is providing further support for equities

- Central banks and Governments continue to apply rescue measures as COVID-19 continues to see increased infections dampening social and economic activity.

The Big Picture

We started last month’s update with the thought that the worst could be behind us but that volatility might still spook markets for a while to come. A quick look at key equity markets tells a more positive story for May with the ASX 200 adding 4.2% to the 8.8% gained in April. The S&P 500 added 4.5% to the 12.7% gained in April.

We still think it’s too soon to assume normal reliance on macroeconomic data. We expected the numbers to remain volatile and we were not disappointed.

The big picture we are focusing on is the mood in the markets about re-opening economies. In one month, we have gone from dire predictions of nothing opening to what looks like an orderly opening in Australia, the US and Europe. Yes, there are pockets of confusion but the stock markets seem to have been buoyed by the fact that an orderly return to work is already beginning to happen.

So long as there is one person carrying the virus there is a chance for others to contract it. There is a very high probability of a second wave. The question is – what form will that wave take?

In Australia, the shut-downs seem to have been largely successful. When someone in a newly opened bar or café contracts the disease, quickly responding to those exposed can minimise the spread. If left unchecked we can easily get back to the problem we had a month or so ago.

Of course, the systems and equipment we now have in place are better to deal with a new outbreak. Australians, by and large, appear to be reasonably responsible. Contrast that with the situation in the USA. There seem to be large clusters of vocal groups claiming all sorts of rights regarding employment and social mobility. It does not matter whose philosophy is correct, viruses only react to people close at hand. We would not be surprised if the relaxing of containment measures proves to be premature and a fresh outbreak occurred in the US and it might be big enough to unsettle markets. In light of the recent social unrest the potential for further outbreaks has likely increased. This will weigh on investment decisions.

Governments and central banks are still applying fiscal and monetary support in amounts that should assist to avert a further escalation of the economic impacts of the COVID-19 crisis. However, at the individual level some groups might be relatively disadvantaged.

Going forward, we are naturally keeping an eye on fresh outbreaks of COVID-19, potential vaccines and cures. They are all potential games changers.

Given the speed of the re-opening of Australia and the US we might expect to see some meaningful data on unemployment from July (to be reported from August). Until then our focus is more on intuition as meaningful forward looking data remains scarce. As economic data releases and in particular corporate earnings estimates stabilise, we will again be able to produce a more informed outlook.

Asset Classes

Australian Equities

The ASX 200 posted a strong +4.2% gain over May with a few sectors standing out. IT (+14.5%), Materials (+8.0%), Property (+7.0%), Telcos (+6.0%) and Financials (+4.7%) were the strongest sectors.

Based on the growing belief that we at least appear to have COVID-19 contained, then the market from a relative value sense is somewhat attractive but with ongoing uncertainty volatility will remain elevated.

Foreign Equities

The S&P 500 posted a +4.5% gain in May which followed a +12.7% gain in April. However, the S&P 500 is down ‑5.8% on the year-to-date.

Many analysts have been quick to point out that the gains in recent years have been mainly concentrated in about 6 or 7 big tech stocks. Without those stocks, they say Wall Street would have just moved sideways.

Index investors need not overly worry about the concentration of strength in stock returns. Others need to be more careful about how they construct portfolios as COVID-19 and the respective Government and Central Bank responses to it have increased the relative attractiveness of some stocks and in particular, some industry sectors over others.

Bonds and Interest Rates

With most national bond rates close to zero, there is not much room for rates to move. We do not expect any of the major countries will be raising official rates any time soon.

With rates low, investors still have to consider deriving some yield from equities.

Other Assets

April was clouded by wild gyrations in the price of oil. West Texas Intermediate (WTI) prices even went negative mid-month as people got caught with the ending of the May futures contract.

We flagged that a repeat situation might occur in mid-May but no such disruption happened. Indeed, WTI oil prices (the relevant US price) were up 88% over May while Brent (the world price) was up 39.8%.

The OPEC problems and shortage of world demand are still big issues but the issue with the futures contracts seems largely contained for now.

After big changes during May the prices of iron ore, copper and oil finished May close to their intra-month highs. It is important for global stability for these commodity prices to stabilise at reasonable levels. At last, that seems to be happening. The Australian dollar (against the US) also finished May at near the intra-month high.

COVID-19 Review

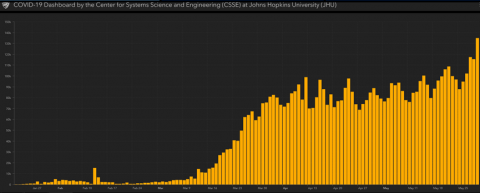

The chart below is the latest from Johns Hopkins University Coronavirus Resource Centre.

The message is quite clear, the reported cases of COVID-19 continues to rise globally while we here in Australia have fared better than most, if not all. The reporting of COVID-19 cases is now escalating in the emerging economies of Brazil, India, Russia and counties in the middle East. Notwithstanding the US has reported circa 1.8 million cases which is in excess of three times that of Brazil in second place at 514,000.

While we in Australia are beginning to see a relaxing of containment measures, the real challenge is that other countries are also heading down this path. Whilst they have achieved apparent containment (i.e. they have flattened the rate of increase in infections), they are still dealing with many actual cases. Consequently, the risk of a second wave is statistically higher for them. While we hope the relaxing of restrictions more generally is successful and does not lead to a second wave of the virus, it is too early to tell and the situation will remain dynamic, despite the more positive experience we are having in Australia.

Regional Review

Australia

Australia’s process of gradually returning to work is becoming politicised after several months of apparent bipartisanship. RBA Governor Philip Lowe highlighted that the September quarter proposed unwinding of Job Keeper and Job seeker payments may be premature. The market appears to be running ahead of the economy at this point.

China

China and the US are at it again but Trump’s end-of-month speech did not bring up the possibility of an escalation of the trade war.

China’s relationship with Hong Kong is still being thrashed out. COVID-19 did little to distract the protagonists.

US

Pockets of the US economy are aggressively re-opening. We are not filled with confidence that the whole process will go smoothly. US citizens seem fixated on their constitutional rights rather than what might be good for the economy at this point.

Europe

The EU has proposed another $1.2 billion recovery fund to assist member countries to weather the recession resulting from the Covid crisis as virtually all member countries have broken EU deficit limits as they support healthcare and businesses to try and sustain their economies.

Rest of the World

Perhaps by next month, news on the rest of the world will match the importance of news on a global pandemic. For now, we focus on how restrictions are relaxed and how lagging economies will be funded.